Green Taxation

Publication Date: 08/07/2025

Highlights:

What is Green Taxation?

Main Green Fiscal Measures in Portugal

What is Green Taxation?

Green taxation refers to the set of fiscal instruments (taxes, fees, and incentives) used to:

Reduce environmentally harmful behaviors (e.g., CO₂ emissions);

Encourage more sustainable habits and investments;

Meet the decarbonization and energy efficiency targets set by Portugal and the European Union.

Main Green Fiscal Measures in Portugal

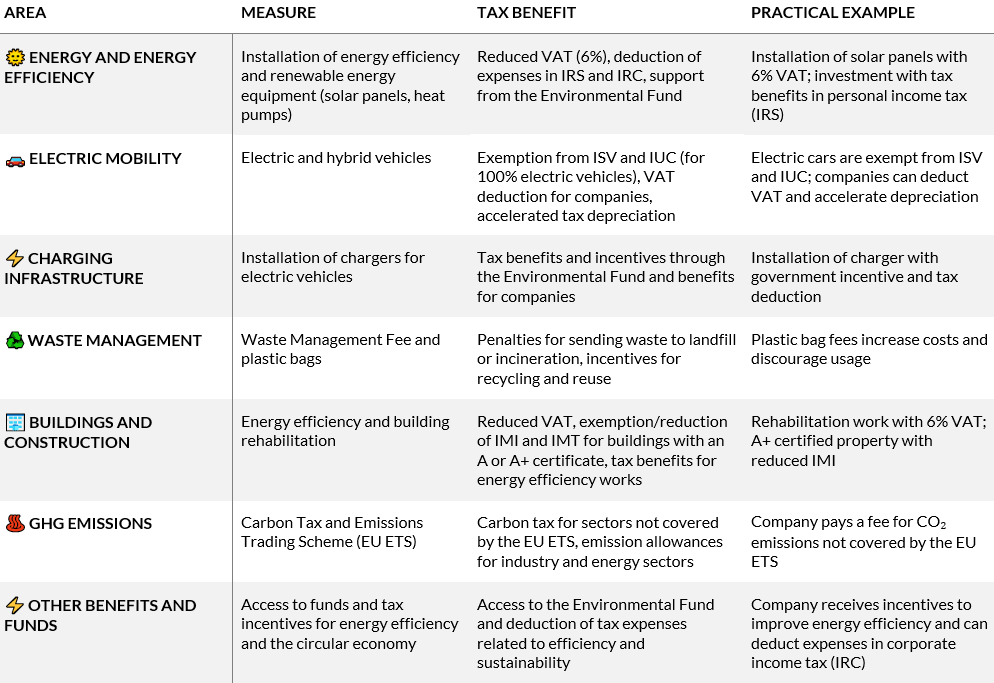

Energy and Energy Efficiency

Tax Benefits for Renewable Energy

Green taxation includes benefits for the installation of equipment and the adoption of renewable energy.

Reduced VAT (6%) for equipment and services related to energy efficiency and renewable energy, such as:

Solar thermal and photovoltaic panels;

Heat pumps and biomass boilers.

Corporate and personal income tax (IRC and IRS) benefits for companies and households that invest in energy efficiency or renewable energy.

Support for Self-Consumption and Energy Communities

Special regimes for renewable energy self-consumption and energy communities, with lower tax burdens and access to special tariffs.

Incentives from the Environmental Fund for installing solar panels and energy efficiency systems.

Electric Mobility

In the automotive sector, green taxation provides for:

Exemption from Vehicle Tax (ISV) for electric vehicles;

Exemption from Single Circulation Tax (IUC) for 100% electric vehicles;

Significant reduction of ISV for plug-in hybrids.

For companies, green taxation allows full VAT deduction on the purchase of electric and plug-in hybrid vehicles (for professional use) and accelerated tax depreciation rates for low-emission vehicles.

Charging Infrastructure

The installation of chargers for electric vehicles also benefits from incentives through green taxation, including tax deductions and support from the Environmental Fund.

Waste Management

Waste Management Fee to discourage unsustainable disposal;

Fee on plastic bags and single-use packaging to reduce waste.

Buildings and Construction

Green taxation promotes energy efficiency and the sustainable rehabilitation of buildings through:

Reduced VAT;

Exemption/reduction of IMI and IMT for buildings with an A/A+ energy certificate.

GHG Emissions

Green taxation includes instruments such as the Carbon Tax for sectors not covered by the EU ETS and participation in the European Emissions Trading Scheme (EU ETS) for intensive sectors.

Other Benefits and Funds

Access to the Environmental Fund for energy efficiency and circular economy projects.

Deduction of sustainability-related expenses in corporate and personal income tax (IRC and IRS).